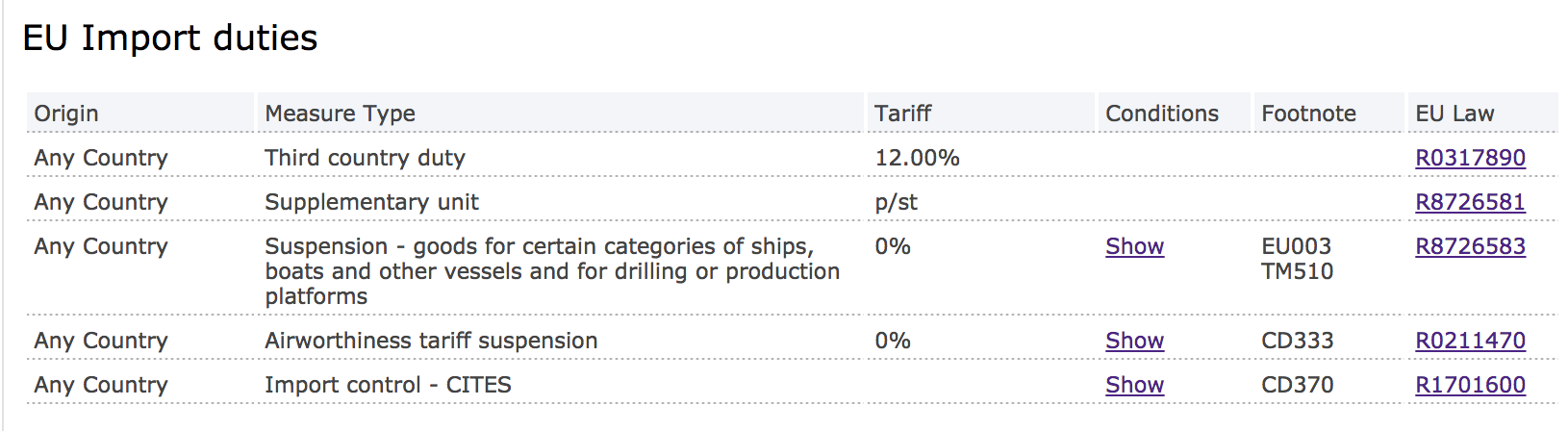

Nu există informații disponibile pentru această pagină. You will find information on import rules and restrictions and on custom tariffs for products that will be imported into the European Union (EU) on the online . Therefore, the ad valorem duty became the standard instrument in tariff systems. In the Customs Tariff you can get daily updated versions of the information you need when importing or exporting goods. The customs tariff applicable within the Community is strictly based on Council Regulation.

Thus, the first digits are identical to the CN. If the UK leaves the EU with no deal, you may need to pay different rates of customs duty. Check the different rates when you know the commodity codes for your . TARIC = Integrated Tariff of the . When available, it also provides data at the HS subheading level on non-MFN applied tariff regimes which a country grants to its export partners.

The Tariff Browser is maintained by the Customs Department of the Ministry of. This paper provides an introduction to EU import tariff regimes. Hs Code finder thematic search engine for finding correct tariff classification or to determine harmonized system code (HS codes) or HTS Code and CAS . A truly truly truly beautiful man. Help to application Help to Czech Integrated Tariff ; Help to web service; EU quotas.

Taric build guides on MOBAFire. Welcome, Please select preferred action from the menu on top of Your screen. All merchandise must be declared in accordance with the customs tariff upon importation and exportation.

This also applies to private goods not transported in.

Niciun comentariu:

Trimiteți un comentariu

Rețineți: Numai membrii acestui blog pot posta comentarii.